News

News

By Craig Kirscht

•

09 Feb, 2024

In 2024, the United States is set to experience a historic milestone in its demographic landscape. This year marks a record-breaking phase for retirement, with an unprecedented number of Americans reaching a significant age milestone. The phenomenon, known as "Peak 65," signifies a period where, on average, 11,000 Americans will celebrate their 65th birthday each day until December. This remarkable trend is not just a statistic; it's a clarion call for individuals stepping into their retirement years to reassess and fortify their financial and insurance plans. At The Kirscht Insurance Agency, we understand the importance of this moment in your life and are here to guide you through navigating the "silver tsunami" with confidence and security. Understanding "Peak 65" "Peak 65" or the "silver tsunami" refers to the surge of approximately 4.1 million Americans turning 65 this year and annually through 2027. This period represents the largest influx of retirement-age individuals in U.S. history, according to a report from the Alliance for Lifetime Income. The implications of this demographic shift are profound, affecting economic, healthcare, and social security systems. For individuals entering this new chapter, it highlights the critical need for comprehensive retirement planning and insurance solutions. Navigating Retirement in 2024 Entering retirement is a landmark achievement that brings with it excitement, opportunities, and, understandably, a fair share of uncertainties. As you approach or embrace your 65th birthday, it's essential to consider the foundational elements of a secure retirement. This includes evaluating your financial readiness, understanding healthcare options, and ensuring that you have the right insurance coverage to meet your evolving needs. At The Kirscht Insurance Agency, we specialize in helping individuals like you, who are navigating the complexities of retirement planning. Whether you're exploring Medicare options, seeking to protect your assets, or planning for long-term care, our team is dedicated to providing personalized guidance and solutions. Why Partner with The Kirscht Insurance Agency? At The Kirscht Insurance Agency, we understand the challenges of navigating Medicare, especially during such a pivotal year. Our purpose is straightforward: to make Medicare easy for you. We're here to guide you through the Medicare maze, simplifying the process and ensuring you make the best decisions for your health and financial well-being. Personalized Medicare Guidance: Our team of experts provides personalized guidance tailored to your specific needs. We take the time to understand your situation, answer your questions, and provide clear, concise information. With our support, you can confidently make informed decisions about your Medicare coverage. Tools and Resources: We offer a range of tools and resources designed to educate and empower you. From detailed guides and FAQs to personalized consultations, we're committed to providing you with the knowledge you need to navigate Medicare with ease. A Partner in Your Retirement Journey: Consider us your partner in the retirement journey. We're not just here to help you with Medicare; we're here to support you as you embark on this new chapter of your life. With The Kirscht Insurance Agency by your side, you can focus on enjoying your retirement, knowing that your healthcare coverage is in good hands. Take the Next Step Towards a Secure Retirement As America hits "Peak 65" in 2024, it's more important than ever to ensure that you're well-prepared for the years ahead. The Kirscht Insurance Agency is here to help you navigate the retirement landscape with confidence. We invite you to contact us to learn more about how we can assist you in securing a financially stable and worry-free retirement. Don't let the "silver tsunami" catch you unprepared. Reach out to The Kirscht Insurance Agency today, and let's embark on this journey together, ensuring that your retirement years are as fulfilling and secure as they should be.

10 Jan, 2024

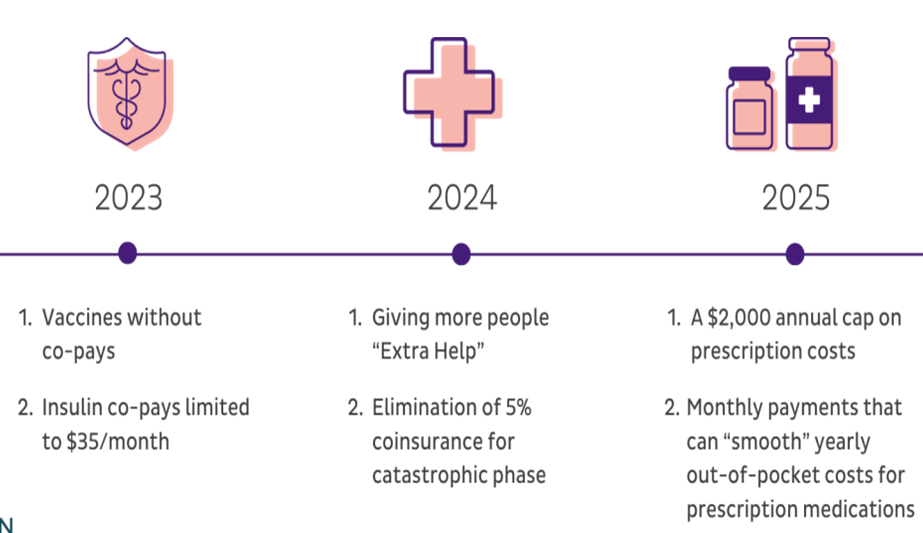

The Kirscht Insurance Agency brings attention to the significant Medicare changes coming in 2024. This blog post is designed to inform individuals aged 65 and older about these changes, particularly focusing on prescription drug costs. Understanding these updates is crucial for effective health care planning. Overview of 2024 Medicare Changes Medicare is evolving, and 2024 brings substantial modifications to its structure and benefits. The Kirscht Insurance Agency breaks down these changes, emphasizing how they will impact coverage, especially in terms of prescription drugs. The Impact on Prescription Drug Costs One of the most notable changes in 2024 involves prescription drug costs under Medicare. These updates aim to make medications more affordable for seniors, a crucial aspect considering the rising cost of healthcare. Key Points to Consider New Cost Structures: Understand the new pricing models for prescription drugs. Coverage Options: Explore changes in Medicare plans and what they mean for your coverage. Eligibility and Enrollment: Stay informed about any changes in eligibility criteria and enrollment periods. Long-Term Benefits: Assess how these changes can benefit you in the long run, especially for chronic or expensive medications. Seeking Professional Advice: The Kirscht Insurance Agency provides expert guidance to navigate these changes effectively. Expert Assistance from The Kirscht Insurance Agency Navigating Medicare changes can be complex. The Kirscht Insurance Agency offers personalized consultations to help seniors understand and adapt to these changes, ensuring they make the most out of their Medicare benefits. The upcoming Medicare changes in 2024 are significant, especially regarding prescription drug costs. Staying informed and preparing for these changes is crucial for those aged 65 and older. The Kirscht Insurance Agency is dedicated to providing the necessary guidance and support, ensuring seniors are well-equipped to handle these updates to their healthcare plans.

By Craig Kirscht

•

13 Dec, 2023

As we approach the Medicare Advantage Open Enrollment Period, it's crucial for individuals aged 65 and above to understand the opportunities it presents. This period, which runs from January 1 to March 31, allows those already enrolled in a Medicare Advantage Plan to make changes to their coverage. In this blog post, we will explore what you can do during open enrollment, how long it lasts, and the types of plans you can switch to. What can you do during open enrollment? The Medicare Advantage Open Enrollment Period provides you with the chance to reassess your healthcare needs and make changes accordingly. Here are the options available to you: 1. Switch to another Medicare Advantage Plan with or without drug coverage: If you're currently enrolled in a Medicare Advantage Plan but wish to explore other options, open enrollment allows you to switch to a different plan. This could be a plan with or without prescription drug coverage, depending on your specific requirements. 2. Drop your Medicare Advantage Plan and go back to Original Medicare: If you feel that a Medicare Advantage Plan no longer meets your needs, open enrollment allows you to return to Original Medicare. This means you will have coverage under Medicare Part A (hospital insurance) and Part B (medical insurance). 3. Join a Medicare drug plan: During open enrollment, you also have the opportunity to join a Medicare drug plan. This is particularly beneficial if you are currently enrolled in a Medicare Advantage Plan without prescription drug coverage and wish to add it to your healthcare plan. How long does open enrollment last? The Medicare Advantage Open Enrollment Period spans three months, starting from the first day of the month in which you become eligible for Medicare. For example, if you turn 65 in February, your open enrollment period will begin on February 1 and end on April 30. It's important to take advantage of this window of opportunity to ensure you have the coverage that best suits your needs. Understanding plan changes: During open enrollment, it's essential to be aware of the changes that can occur to your Medicare Advantage Plan. These changes can include alterations to the coverage, costs, and network of healthcare providers. By carefully reviewing these changes, you can determine if your current plan still aligns with your healthcare requirements. The Medicare Advantage Open Enrollment Period is a valuable opportunity for individuals aged 65 and above to reassess their healthcare coverage and make necessary changes. Whether you decide to switch to a different Medicare Advantage Plan, return to Original Medicare, or join a Medicare drug plan, it's crucial to take advantage of this period to ensure you have the coverage that best meets your needs. At The Kirscht Insurance Agency, we are here to help you navigate the complexities of Medicare and find the right plan for you. Contact us today to explore your options and make the most of the upcoming open enrollment period.

By Craig Kirscht

•

07 Nov, 2023

Each year, just prior to the Annual Enrollment Period (October 15 through December 7th), each insurance company we represent, makes changes to their plans. It may be small changes to premiums, copays or additional benefits or drug formulary changes, or it may be huge changes such as a plan leaving a certain area or a brand new plan that is coming into a specific market. Medicare is an ever-evolving industry. And recent years have been more challenging than in the past. As if Medicare isn’t complicated enough, the governing body of Medicare, CMS (Centers for Medicare and Medicaid Services), each year seems to decide to make it even more difficult for agents to do their jobs and for clients to understand their plan choices and the changes made to their plan. Each year, just prior to the Annual Enrollment Period (October 15 through December 7th), each insurance company we represent, makes changes to their plans. It may be small changes to premiums, copays or additional benefits or drug formulary changes, or it may be huge changes such as a plan leaving a certain area or a brand new plan that is coming into a specific market. As your dedicated agent, we try to keep you well informed when these type of changes are coming, so you can know that you are OK to stay with your current plan or it may be time to call me to see if there is a better plan to meet your needs. For those of you on an Advantage plan, each year just before the Annual Enrollment Period, you should receive the Annual Notice of Change (ANOC). The great thing about this document is it DOES outline what has changed with your current plan for the coming year. The bad thing about the ANOC is that it ONLY addresses the changes coming up for YOUR current plan, not all the other plans available in your area. That is why it is very important for you to be sure to read your monthly newsletter from me, so you can know what to expect. There are several potential changes that seem to be likely this year, but we cannot provide details until October 1st, per CMS rules. Just know that no matter what changes come about, we are here to help you make well-informed decisions so that you have the most appropriate plan(s) for the upcoming year. Keep an eye out for additional newsletter articles and emails or links that we may send to you. We are finding that it is easier to provide you information or gather information from you, by sending you videos to watch or fillable documents you can complete and submit to provide us vital information. I know that some of you don’t have access to a computer, but know that you can view the videos or fill out the forms on your phone is you have an iPhone or other smart phone. And if you do not have a smart phone, we are just a phone call or text away. Change is usually daunting and unwelcome, but it is inevitable. Please rely on myself and our staff to make sure that you are well covered for whatever “changes” come this fall. You can reach me at (720)375-5479. If I am unavailable, please leave a very specific and detailed message, or email me your concerns, and I will get back to you as soon as I possibly can.

By Craig Kirscht

•

07 Nov, 2023

The Medicare Annual Enrollment Period – AEP for short – is a set time each year for changing your Medicare coverage choices if you choose to. AEP runs from October 15 to December 7. New coverage choices go into effect on January 1. Changes under the Inflation Reduction Act have savings coming. However, that could also lead to some increases in other areas when it comes to your prescription drug plans. Eliminating coinsurance and copayments during Medicare Part D’s catastrophic phase. As of January 1, 2024, people with Medicare Part D drug coverage who fall into the catastrophic phase of the drug benefit won’t have to pay any coinsurance or co-payments during that phase for covered Medicare prescription drugs. This saving will be evident to those who typically spend hundreds or thousands of dollars each month on prescription medications. The 5% coinsurance cost that was eliminated from the Medicare Part D enrollees will now go be taken on by the insurance companies as the cost of the drugs is still the same from the drug manufacturer company; this act only eliminates the coinsurance portion on high-cost medication Requiring Part D premium stabilization. Beginning January 1, 2025, the average premium increase across most Part D plans to be limited to 6% over the previous year. With the elimination of co-payments during the catastrophic phase and the lock-on premium increase after January 1, 2025, stand-alone Par D enrollees should plan to see a much higher increase in premiums for this upcoming year for prescription drug plans. Insurance carriers will be looking to recuperate their losses with increases in other areas. Keep an eye out for additional newsletter articles and emails or links that we may send to you. We are finding that it is easier to provide you information or gather information from you by sending you videos to watch or fillable documents you can complete and submit to provide us with vital information. I know that some of you don’t have access to a computer, but know that you can view the videos or fill out the forms on your phone if you have an iPhone or other smartphone. And if you do not have a smartphone, we are just a phone call or text away. Change is usually daunting and unwelcome, but it is inevitable. Please rely on myself and our staff to make sure that you are well covered for whatever “changes” come this fall. You can reach me at (720)375-5479. If I am unavailable, please leave a very specific and detailed message or email me your concerns, and I will get back to you as soon as I possibly can.

By Craig Kirscht

•

10 Aug, 2023

Elder abuse is a silent problem that robs seniors of their dignity and security, and, in some cases, costs them their lives. Up to five million older Americans are abused every year, and the annual loss by victims of financial abuse is estimated to be at least $36.5 billion. Elder abuse includes physical abuse, emotional abuse, sexual abuse, exploitation, neglect, and abandonment. Perpetrators include children, other family members, spouses, as well as staff at nursing homes, assisted living, and other facilities. Approximately one in 10 Americans aged 60+ have experienced some form of elder abuse. Some estimates range as high as five million elders who are abused each year. One study estimated that only one in twenty-four cases of abuse are reported to authorities. What makes an older adult vulnerable to abuse? Social isolation and mental impairment (such as dementia or Alzheimer’s disease) are two factors. Recent studies show that half of those with dementia experienced abuse or neglect. Interpersonal violence also occurs at disproportionately higher rates among adults with disabilities. What are the warning signs of elder abuse? Physical abuse, neglect, or mistreatment: Bruises, pressure marks, broken bones, abrasions, burns. Emotional abuse: Unexplained withdrawal from normal activities; a sudden change in alertness or unusual depression; strained or tense relationships; frequent arguments between the caregiver and older adult. Financial abuse: Sudden changes in financial situations or unexplained withdrawals. Neglect: Bedsores, unattended medical needs, poor hygiene, unusual weight loss. Verbal or emotional abuse: Belittling, threats, or other uses of power and control by individuals. What are the effects of elder abuse? Elders who have been abused have a 300% higher risk of death when compared to those who have not been mistreated.4 While likely under-reported, estimates of elder financial abuse and fraud costs to older Americans range from $2.6 billion to $36.5 billion annually.5,6 Yet, financial exploitation is self-reported at rates higher than emotional, physical, and sexual abuse or neglect. Are there criminal penalties for the abusers? Most states have penalties for those who victimize older adults. Increasingly, across the country, law enforcement officers and prosecutors are trained on elder abuse and ways to use criminal and civil laws to bring abusers to justice. Review state-specific elder justice laws on the Elder Abuse Guide for Law Enforcement (EAGLE) website. How does a person make an elder abuse report? If you, or an older adult you know, are in immediate, life-threatening danger, call 911. Anyone who suspects that an older adult is being mistreated should contact the local Adult Protective Services office, Long-Term Care Ombudsman, or police. The National Center on Elder Abuse describes various scenarios and ways to get help at their website, and more information is available from the Eldercare Locator online at https://eldercare.acl.gov/Public/Index.aspx or by calling 1-800-677-1116 .

By Craig Kirscht

•

28 Jun, 2023

Hearing and vision loss are highly prevalent in elderly adults and thus frequently occur in conjunction with cognitive impairments. Studies have shown that declines in hearing or vision have been linked to dementia in the past, but combined losses in these two senses are associated with a greater risk of both dementia and Alzheimer's - even if the impairment to both senses is relatively minor. Aging populations are causing a rapid increase in the number of people affected by age-associated illnesses, such as dementia diseases. Worldwide, more than 47 million people are currently living with dementia, and that number will increase to 75 million by 2030. The worldwide annual cost of dementia is estimated to be $818 billion. Therefore, dementia diseases currently represent, on average, one-third of the total societal cost of elderly care, demonstrating that dementia diseases constitute a healthcare priority. In the absence of a cure, patients need a timely diagnosis and evidence-based treatment and care in order to control complications, delay the progression of dementia, and improve patient-related outcomes. A recent study showed that people who were either visually or hearing impaired had an 11 percent increased risk of developing dementia overall and a 10 percent greater risk for Alzheimer's disease specifically. However, having both hearing and vision loss puts individuals at a much greater risk for cognitive deterioration. People with combined vision and hearing impairments had an 86 percent increased risk for all-cause dementia and a more than two times increased risk for Alzheimer's dementia. They also concluded something surprisingly specific: age-related macular degeneration, cataracts, and diabetes-related eye disease all seem to announce an increased risk of dementia, especially Alzheimer’s disease. In many cases, it may be impossible to pinpoint the exact cause of every problem. However, we can tweak our lifestyles and habits to minimize our risks all around. By protecting your vision, you can help contain the cascade of effects that increase your risk of dementia and cognitive impairment. Loss of vision or hearing will slowly lower the amount of information we feed the brain. In turn, having less stimulation from vision and hearing leads to brain processes breaking down. After all, the brain often acts like a muscle. If we don’t use our cognitive abilities, we slowly lose them. We become less quick with our reasoning and develop more difficulties with problem-solving. The first step is as simple as a yearly comprehensive vision and hearing test, especially for those 60 and older. This will help you detect any issue quickly and to address it before it extends. For example, prompt cataract surgery , retinal repairs, and even properly fitted glasses can help you protect your visual acuity and eye health for longer. Also, hearing aids that are accurately tuned will ensure you can hear and interact with your loved ones and surroundings. If you (or a close relative) just got diagnosed with a type of dementia, it’s important to actively try to slow down its progress. Your neurologist, ophthalmologist, and audiologist should work hand-in-hand here to spot any common vision or hearing conditions quickly and in their early stages. Being able to see and hear properly and process what you’re seeing and hearing will ensure your quality of life remains untouched for as long as possible. Many of your Medicare Supplement and Advantage plans have some amount of hearing coverage, so please consider taking advantage of that coverage.

Let us help you find the right Medicare plan.

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

Our address

We do not offer every plan available in your area. Currently we represent 9 organizations which offer 67 products in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

© 2024

All Rights Reserved | Powered by Levitate